What is Validium?

Validium is another Layer 2 scaling solution that utilizes Validity Proofs but does not store data on Layer 1. Similar to zkRollup, Validium is limited to application specific implementations primarily geared toward decentralized exchanges (DEXs). The main benefit with Validium is that operators can not publish invalid state transactions which eliminates the long withdrawal holding periods associated with Fraud Proof solutions like Plasma.

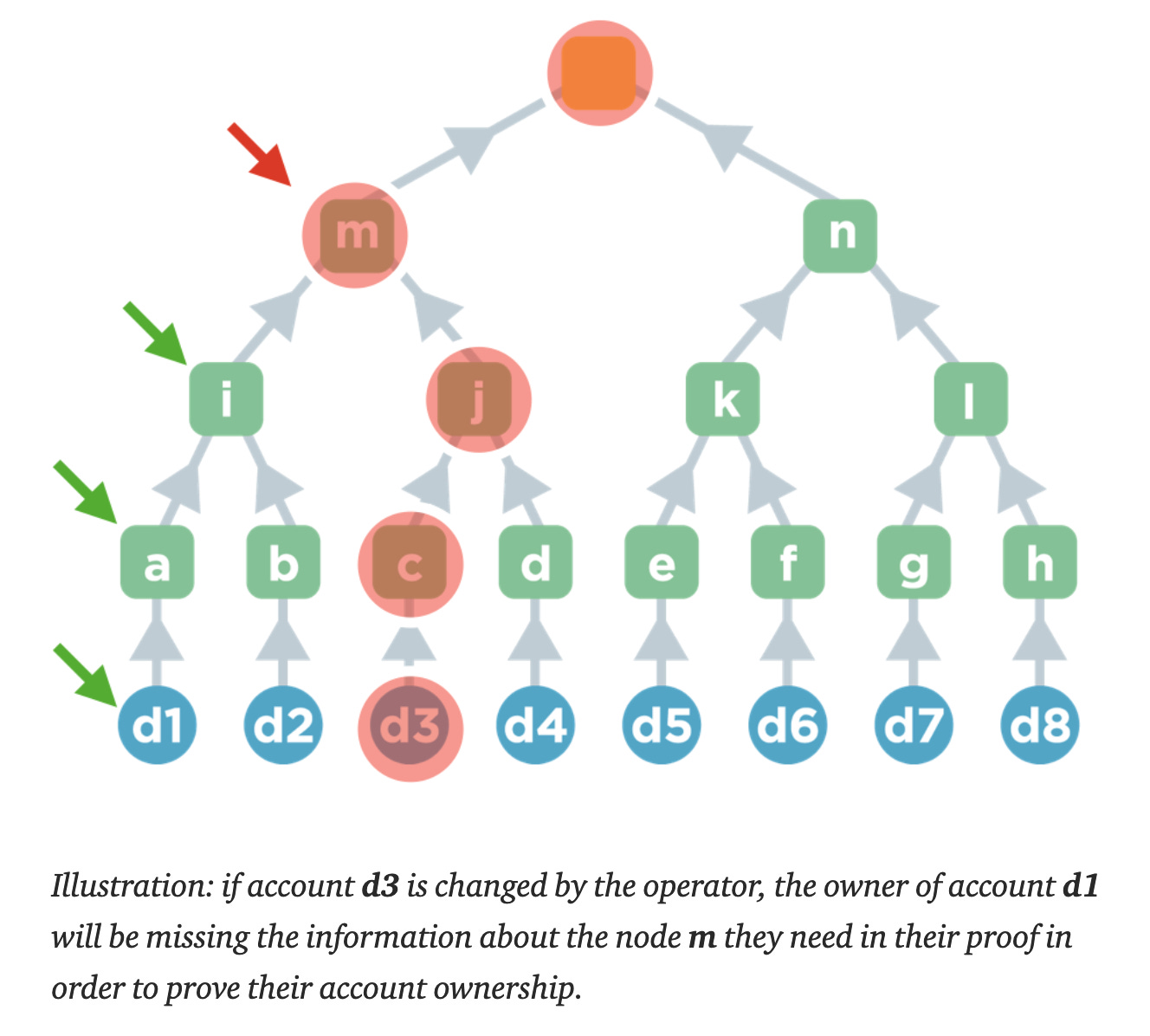

Validium is susceptible to data withholding attacks since it does not have any data availability guarantees like zkRollup’s. This occurs when a data availability operator makes a change in the Merklized state without disclosing the state change to users. The other users are then unable to create a Merkle proof of ownership for their account and their funds are frozen.

Figure 7. Data withholding attack on Validium.

Examples of Validum projects:

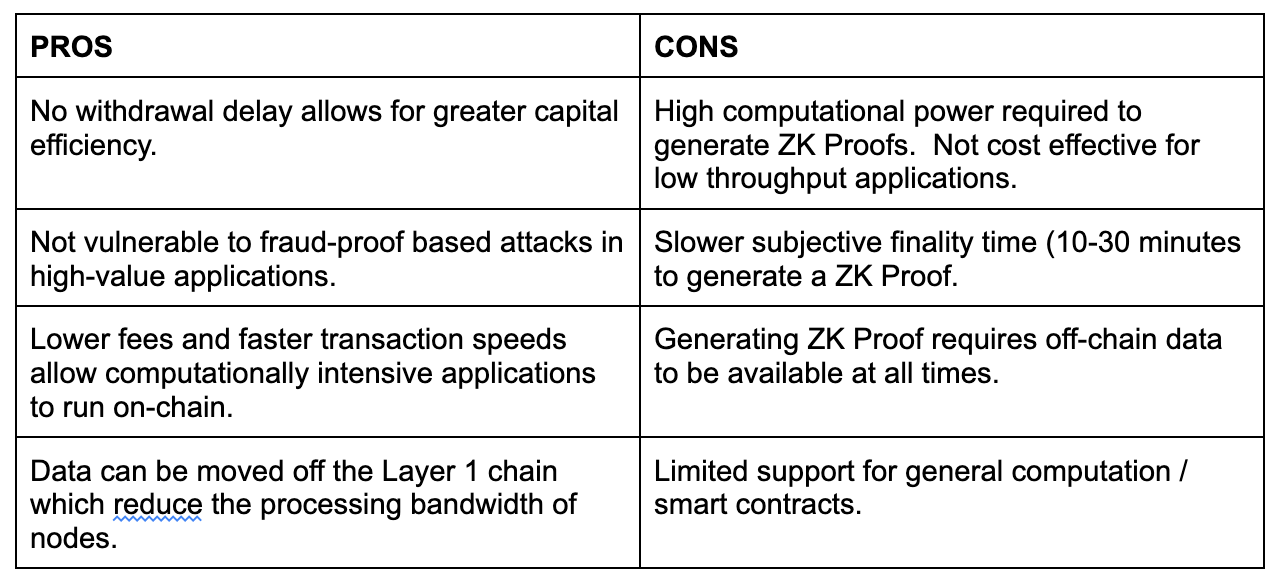

Table 6. Validium Pros vs Cons.

What about sidechains?

Sidechains are blockchains with their own consensus models and block parameters that run parallel with the mainnet. Sidechain network nodes are responsible for processing transactions, submitting transactions to blocks, and maintaining consensus across the network. Ethereum sidechains operate independently and do not inherit Ethereum’s security. Strong incentives must be used to prevent collusion-based attacks on validators. Common types of security mechanisms are:

Proof-of-authority: Validators are pre-selected and use public reputations to ensure safety. The trade-off is the lack of decentralization since the validator set is limited.

Proof-of-stake: Validators are selected based on the staking amount that they commit to the protocol. The greater the staked amount, the higher the probability that the node will be selected to the validator set.

Sidechains rely on Byzantine Fault Tolerance (BFT) methods for consensys. Byzantine Fault Tolerance requires a system to resist up to one-third of validator nodes from failing or acting maliciously.

Transactions on the sidechain can be optimized for speed and costs which decongests the main Ethereum network. Assets and data are moved between chains via a TokenBridge. Assets are locked on one chain and minted on another. To reverse this action, assets are then burned and then unlocked.

Examples of current Ethereum sidechains are:

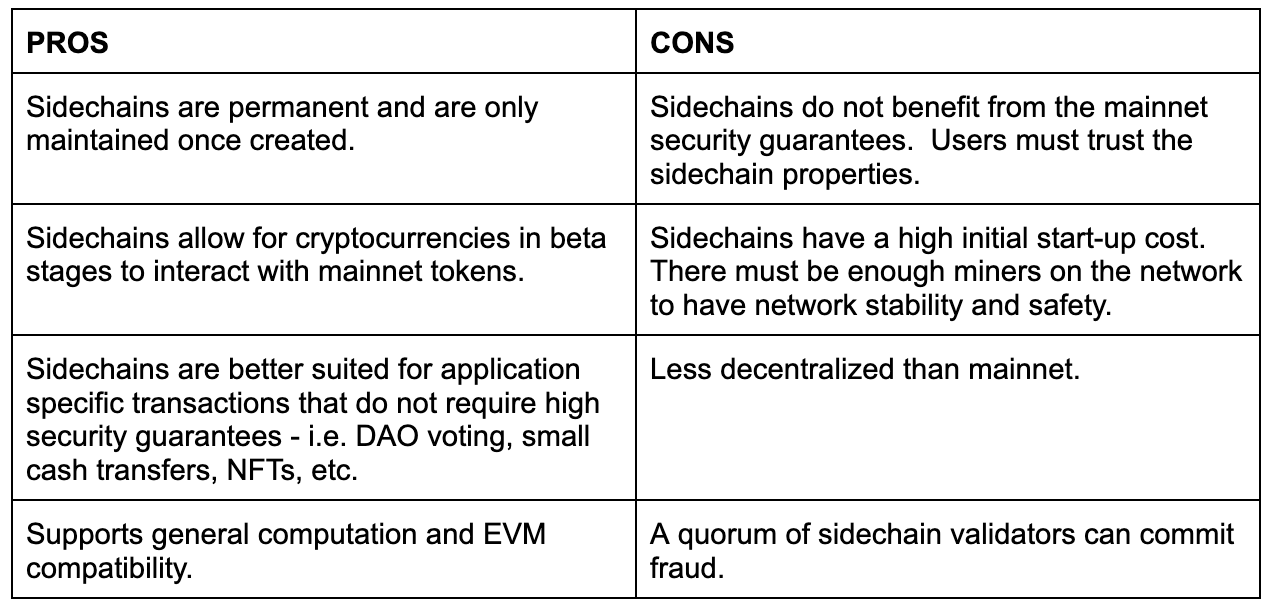

Table 7. Sidechains Pros vs Cons.